The durable argument of whether it's best to buy a new home or older one dates back centuries. And it's never quite been resolved.

For every qualifier, there's a disqualifier. For every "on one hand," there's an "on the other hand."

The truth is, builders can never fully re-create the nation's quaint old neighborhoods, where every house was built architecturally distinct from the neighbor's. And home buyers will never be able to fully assemble their dream homes the way they can on a vacant lot with a fantaz view.Homebuilders and old-line real estate sales people might even bicker heatedly about the topic, with their own "Looks-great! Less-fulfilling!'' twist on the old light-beer argument.

So the choice between the two is always a relative call, not a dollar-and-cents one, says business author and investment expert Ric Edelman.

"There are many factors beyond economics that drive the decision," says Edelman. "Buying a home should be more of a lifestyle decision, because so much of the economics are beyond your control."

Edelman, who penned such bestsellers as "The Truth About Money" and "Ordinary People, Extraordinary Wealth," has built two family homes over the years and is now fixing up a "resale" he purchased..

"One of the fundamental mistakes that consumers make is a rush to judgment," he said. "They often dismiss a new home or a resale when one is far more appropriate for them than the other."

So how do you decide which best fits your needs and personality?

Below are a few pros and cons in the own-resale debate:

Locale: The oft-recited real estate mantra of "location, location, location" is still relevant. Most older, established neighborhoods are in the town's center, which can be good or bad depending on the vitality of your urban area. New subdivisions -- and newer schools -- are generally on the outskirts. But the expense of a daily commute is one factor that many buyers forget to consider, Edelman said.

Price: Existing homes are usually less expensive per square foot, in part because of escalating land costs in new subdivisions. But ownership costs are considered more predictable -- almost inevitable -- in a new home, especially considering the cost of a code upgrade or remodeling of a vintage home. Some builders will include closing costs as part of their price of a new home, although that builder has a set amount he must get from that home to make a profit. Price is more readily negotiable for an existing home. Also, a hidden cost in many new subdivisions is a homeowner's association, with mandatory fees and other assessments as well as architectural controls that may surface at remodeling or expansion time. Do your homework.

Move-in complications, advantages: The resale is sitting there waiting for occupancy, warts and all. But the wait for a new home can seem interminable, though the buyer can check on quality control as it's being built. If your finished house is among the first in a new subdivision, prepare to navigate through construction teams and precariously misplaced nails for months on end. And don't forget that daytime hammer serenade.

Neighborhood: "People moving into new neighborhoods are more homogeneous -- the same things that appeal to you also appeal to others like you," says author Edelman. "When a development goes up, it offers an opportunity for you to help create your own neighborhood lifestyle. If you want to move into community where your children have lots of playmates, that may be for you." In an older community, he said, people have moved in and out over the years and you tend to get more diversity of neighbor backgrounds that include older people, singles, families and renters.

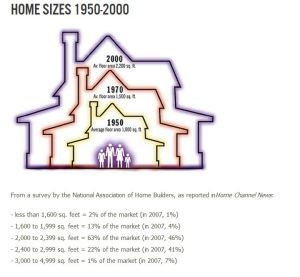

Living space and design: Lower building costs of the past mean more home for the money for the buyer of a resale. Resale basements may have been finished out nicely for additional living space. On the other hand, new-construction homes often employ more efficient, innovative uses of square footage and property. Also, newer "zero-lot-line" developments offer more living space per square foot than a same-size lot that surrounds a resale.

Customization: In a new house, you can pick your own color schemes, flooring, kitchen cabinets, appliances, custom wiring for TV's, computers, phones and speakers, etc., as well as have more upgrade options. Modern features like media rooms, extra-large closets and extra-large bathrooms and tubs are also more attainable in ground-up construction. In a used home, you rely largely on the previous resident's tastes and technological whims, unless you plan to farm thousands into a remodeling and rewiring. Be warned: It's unwise to wallpaper for at least one year in a new house until it settles, says Edelman. The wallpaper will tear. (But it is OK to paint.)

Character: While many new homes are built in "contextual" style, which blends elements of the old and the new, it's still hard to emulate a pre-Civil War house in New Orleans, a Victorian home in San Francisco or a brick Row House in Boston. Hardwood floors, vaulted windows, high ceilings, built-in cabinetry and other design nuances express a certain individuality in older homes that's nearly impossible to copy. Many new-home buyers believe they put the character in their own homes.

Safety: Builders have to follow very strict guidelines in new-homes and additions, especially in the West and Northwest, where earthquake safety standards must be observed. In general, new homes are usually more fire-safe and better accommodating of new security and garage-door systems.

Landscaping: Mature trees, robust shrubs, gardens, rose bushes and perennially well-watered lawns are some of the rewards of an older home, while most new homes are apt to yield wee trees, fewer walkways and sparse vegetation. Landscaping is an expensive proposition today for the cost-conscious home builder.

Energy efficiency: Advantage: new construction. Game, set and match as well. New-home designers can use new building materials such as glazed Energy Star windows, thicker insulation and other technology that will lower future energy costs for the owner. Most states now have minimum energy-efficiency requirements for new construction. Kitchens and laundry areas in new homes are designed to house more efficient energy-saving appliances. Older homes, unless they have undergone an energy retrofit, usually cost much more per square foot to air-condition and heat.

Amenities: Many new subdivisions offer neighborhood clubhouses, swimming pools, playgrounds, bike and jogging trails and picnic venues for residents. Older homes don't, although many have better access to urban shopping venues and restaurants because they're part of old, self-containing city-planning philosophies.

Maintenance: The charm of an older home often goes hand in hand with increased maintenance, especially if the previous owner(s) were not vigilant in upkeep. Building materials may be harder to replace or match in an expansion or remodeling. New homes generally come with at least a one-year warranty for the repair of some problems that develop as it settles into its foundation. But know what your warranty covers. Many are elusively written.

Taxes: Newer homes tend to spring up in less-developed, outlying municipalities, which may impose higher taxes on you because they're subsidizing fewer inhabitants than the central metropolitan area. Your community will still need fire and police coverage, sidewalks, sewers and probably a new school. A more established home in a built-out area has a little more predictable tax structure.

Increasingly, "new" is no longer an option in some towns, and neither is "old" for most folks there. Realtor Graham Baxter of Los Gatos, Calif., operates in the Silicon Valley market, where most of the sales are $1 million plus and there is virtually no new housing stock. "The only new homes that tend to get built are the result of tear-downs," he said.

To find new subdivisions and less expensive homes in the region, "You have to go 50 miles from the Valley to Tracy or Stockton. But you'd be surprised how many people make that commute."

Compromise is obviously the name of the new-or-resale home-buying game, as it becomes apparent that the perfect house and perfect site probably don't really exist. And finding what you want can be a protracted headache.

"Buying a home from anybody is much more complicated and challenging than people realize," says Beau Brincefield, real estate attorney and author of "Brincefield's Guide to Buying a Home; The Twenty-One Biggest Mistakes People Make When Buying a Home."

With new-construction homes, "You've got all the same problems you have with resale homes and then some," says Brincefield, who is a frequent lecturer on real estate and civil litigation. Brincefield says dozens of Web sites are created by people who bought defective new homes from builders but who have since discovered they have little recourse. "Obviously, there are a lot of good builders who stand behind their homes...and most people go through this process with no problems," he said. "But those aren't the ones I see."

Some builders create no-asset, limited-liability companies in order to buffer themselves from claims, he said. Home warranties, especially those purchased from third-party warranty companies, usually aren't as all-protective as consumers first believe. Read the fine print, Brincefield advises.

When considering purchase of a new home, make certain you are dealing directly with a builder who has a substantial net worth and not a no-asset subsidiary, he said. Avoid giving builders upfront money, he says. "If they have your deposit and go under, you won't get either the house or your money back. Make sure the purchase contract is contingent on financing."

Whether buying a new or resale home, always hire a properly credentialed individual to inspect the premises before you settle, Brincefield said. "Even some nationally known home inspection firms may send out an individual inspector who is minimally qualified to perform a good inspection."

Because of the contract forms that many inspection firms use, the company typically has little financial risk for a poor inspection, Brincefield warns. "If they miss a bad roof, all they have to do is refund you the $200 or $300 (fee). Anytime you are given a written contract to sign, you should read it carefully and make sure you understand what you are signing."

Buying a new or resale home without an experienced real estate attorney "is like playing Russian roulette," he said. "Sure, there is only one bullet in the chamber, so you're probably going to make it out all right. But there's always that one bullet."

Potential buyers should also scope out any vacant fields in the area surrounding their planned purchase and check with the city or zoning board to determine how that land is zoned, experts say. Recent buyers into both new and established subdivisions across the country have been stunned to discover the long-fallow retail parcel down the block will soon give way to a big-box retail megastore.

Because they like the customization options, first-time home buyers will sometimes opt for a new town home instead of a resale, with intent to move up to a single-family home in a few years, Edelman said. But that means the same builder, who will probably continue to build new units nearby for the next few years, will in essence determine the future value of that town home. That means the selling price for the owner of the town home could be tied to -- or just below -- the price of that newer town house the builder is still constructing.

While buying a used or new home should be largely a lifestyle decision, that still shouldn't prevent the potential buyer from also thinking like a seller, Edelman said.

"For you will be one someday," he said.